Vitarich Sets New Nine-Month Revenue Record

Exceeds P7 Billion Milestone

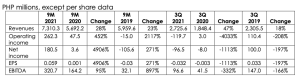

November 15, 2021– Vitarich Corporation (PSE:VITA) revenues continued to reach new highs, surpassing the P7 billion mark for the first time in any nine-month period on record. Revenues were up 28% year-over-year to P7.3 billion, which were well ahead of pre-pandemic levels and were only P572 million short of full-year revenues achieved in 2020 and P1.6 billion in 2019.

For the third quarter, revenues reached P2.7 billion, an increase of 47% compared to P1.8 billion in 3Q 2020, and an increase of 15% from P2.4 billion in 2Q 2021.

“In the face of evolving market dynamics caused by COVID-19 challenges, we continue to be responsive and agile to meet the needs of our stakeholders,” said Rocco Sarmiento, President and CEO. “In doing so, we are seeing new revenue records in all our segments, while also successfully investing in a pipeline of CAPEX projects to drive our future growth. Yet we are still in the early stages of gaining market share. We expect further expansion of our customer base through broadened product offerings as well as distribution. We also expect benefits from our newly upgraded facilities to support our growing hotel, restaurant, and institutional (HRI) customers.”

Volumes picked up strongly across all business segments but were partially offset by the decline in average selling prices of chicken and day-old-chicks due to the reimposed series of stricter quarantine measures from August through October.

Cost of goods increased 25% to P6.6 billion mostly on higher prices of raw materials such as wheat, soybean, and corn which rose by as much as 19% in the third quarter primarily from global logistics challenges. As a result, margins came in softer-than-expected.

Gross profit was P692 million, up 72% from a year ago, while operating income stood at P262.3 million, up nearly 6 times but down from P382.0 million in 1H 2021.

Operating expenses were maintained at 6% of revenues, reflecting the company’s ability to manage costs effectively, including administrative costs, and selling and distribution costs even as it incurred higher marketing spend for the recently launched Freshly Frozen line.

Net income was P180.5 million with earnings per share of P0.059.

“While we are pleased with our top-line development particularly volume growth, we remain focused and committed to achieving our profitability goals. We have several initiatives underway which we believe will get us there and will play to our strength long term.”

Segment Highlights

The Feeds segment, which accounted for 47% of total revenues, was up 9% over nine months to P3.4 billion. The business enjoyed higher volumes of 8% for commercial and tie-up customers combined. The decrease in gross margin mainly reflects the ongoing market conditions under COVID-19 which are driving up the cost of raw materials. The Feeds segment produces and markets animal feeds, health and nutritional products and supplements to various distributors, dealers, and end users nationwide.

The Foods segment, which accounted for 42% of total revenues, registered a 40% increase to P3.1 billion. The business benefitted from a 25% increase in volume and 12% increase in selling prices. The Food segment sells chicken broilers to HRI customers, supermarkets, and wet markets.

The Farms segment, which accounted for the remaining 11% of revenues, surged 134% to P799 million. Fair value adjustments on biological assets amounting to P271 million was recognized as part of revenues.

Outlook

“With over 85% of Metro Manila’s target population fully vaccinated, we expect better performance in the seasonally stronger fourth quarter for several reasons, including: a higher demand due to the holiday season, the easing of COVID-19-related movement and business restrictions as well as indications that overall confidence has improved and momentum is supportive of an ongoing recovery. For 2022, election spending may also result in accelerating economic activity and rebuilding favorable environment for businesses— providing the boost we need.”

“At the same time, we anticipate higher production costs mostly from rising input costs of our main raw materials and other costs of trade following the disruptions of the pandemic to transport and logistics. Despite this trend, we expect our investments in technology, digitalization, research and development (R&D), storage facilities, and on human capital to help contain upward pressure on costs and contribute to productivity.”

“By executing on our strategic priorities, we continue to enhance our capabilities to achieve our medium-term goal of a net income compound annual growth rate (CAGR) of at least 30% from 2019 to 2026. This outlook reflects the following growth strategies:

- Grow the core by 1) adding new Original Equipment Manufacturer (OEM) accounts and deepening our business with many of our existing HRI customers through joint product development, customization, and collaborative supply chain demand planning; and 2) expanding downstream by focusing on our Cook’s brand and introducing ready-to-cook lines in Greater Manila, Central Luzon, and Bicol in the near-term;

- Diversify into adjacent business areas to capture domestic opportunities in hog repopulation and pork meat market following African swine fever (ASF) by replicating our poultry contract growing operations and building upon our large geographical footprint and trusted partnerships;

- Transform the cost base and deliver profitable growth by 1) managing raw materials volatility and saving on lease payments through development of more warehouses;

2) consolidating feed milling in Luzon; and 3) driving improvements on costs through automation, further integration, innovation, supply chain optimization, and continual assessment in feeds formulation and efficiency;

- Invest and adapt for the future by spending approximately P670M in CAPEX until 2022 to 1) construct a new feed mill plant in Davao—adding +60% capacity to 473,200 MT by 2024; 2) upgrade dressing plant facilities in Bulacan to double site capacity; and

3) implement operations automation and information systems which began in 2017;

- Create shared value for Philippines’ food self-sufficiency.”

###

ABOUT VITARICH CORPORATION

Vitarich Corporation (PSE: VITA) is a pioneer, agribusiness partner, and leader in the animal feeds industry in the Philippines since 1950. Recognized with international standards for sanitation, food safety, and quality, VITA operates in three primary industry segments: feeds, foods, and farms—forging livelihoods and nourishing lives. For more information, visit www.vitarich.com or contact ir@vitarich.com