Vitarich Reports Record First-Half Revenues Amid Market Headwinds

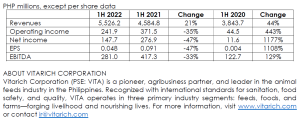

August 4, 2022– Vitarich Corporation (PSE:VITA) reports revenues of P5.5 billion for the first half of 2022, an increase of 21% from P4.6 billion in the prior-year period, led by the Foods business.

“We delivered record-breaking revenue performance even in the face of challenging macroeconomic headwinds” said Rocco Sarmiento, President and CEO. “Through volume gains, responsible price increases, and operational efficiencies, we limited the impact of higher input costs on our profitability. At the same time, we successfully executed on our strategic plan of growing our core. We added several key accounts to our hotels, restaurants, institutional (HRI) customer list—including some leading fast food chains—and launched our

branded chicken products, Cook’s, in various parts of the country.”

Cost of goods climbed 25% to P4.9 billion primarily due to higher sales volume and prices of raw materials, such as wheat, soybean, and corn, which saw an average increase of 32% compared to the same period last year. Similarly, the recent surge in fuel, energy, and labor costs impacted cost of sales as well as operating expenses, which also rose 25%. As a result, gross profit was P591.9 million, representing a gross margin of 11% compared to 14% in the first half of 2021, and operating profit was P241.9 million.

Net income was P147.7 million with earnings per share of P0.048.

“We expect input costs to remain elevated as we move through the balance of the year,” said Melise Arnaldo, Chief Finance Officer. “We are taking necessary actions to manage through the current market conditions while remaining focused on our growth plans and long-term opportunities. We are innovating, sourcing, and finding alternative raw materials when possible, while more prudently managing inventory levels, especially of imported items, in view of pressures on the foreign exchange rate and inflation impact.”

Segment Highlights

• Foods was the largest contributor to revenues at 54%, building on a strong recovery since 2021 and achieving record first half revenues of P3.0 billion, an increase of 55%. Volume expanded 45% supported by an average price increase of 6%. Demand was particularly high in Luzon and Mindanao.

The segment added a total of 13 HRI customers including some leading fast food chains, providing custom product and menu development suited to customer specifications, quality, and cost requirements.

Cook’s dressed chicken was introduced in Isabela, Camarines Sur, Camarines Norte, Albay, and Northern Samar and is now available to HRI customers, supermarkets, and

wet markets in these areas.

• Feeds revenues grew 5% to P2.2 billion driven by pricing, which sequentially rose over the past two quarters to mitigate high input cost inflation. Specifically, pricing increased 14% compared to the year-ago period versus input costs at 23%. As expected, pricing had an unfavorable impact on volume which slightly contracted by 7%. Feeds segment comprised 41% of revenues.

The segment expanded its distribution network across the Cordillera Administrative Region, Negros Occidental, Capiz, and Antique through additional retail stores and end users such as backyard farms.

• Farms revenues declined 44% to P291.5 million, or 5% of revenues. Fair value adjustments on biological assets amounting to P73.7 million was recognized as part of revenues and P55.2 million as part of cost of goods.

Market Insights

Three key themes continued to shape market conditions of the domestic poultry broiler industry in the first half of the year.

First, the marked increase in feed input costs exerted a significant strain in reaching optimal feed conversion ratios targets. As a result, some poultry growers cut costs either by reducing volume or using feed input alternatives, while some carried out price hikes and passed on the increased cost to consumers.

Second, the combination of tighter local border restrictions and the unusually hot weather led to a mid-to-high single digit decline in harvest recovery rates. In Visayas and Mindanao, for example, varying border restrictions increased travel and production times, resulting in stunted growth or death among broilers. In addition, heat stress directly affected livestock growth.

Finally, the shortage of important feed inputs, mainly corn, was a contributing factor to the chicken supply gap in June and is expected to persist as a major source of uncertainty for the industry unless effective measures are implemented to improve the long-term competitiveness of the corn industry.