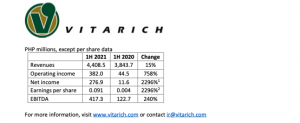

August 16, 2021– Vitarich Corporation (PSE:VITA) reports first half 2021 net income of ₱276.9 million and earnings per share of ₱0.091, an increase of 24 times over the same period last year and the highest level in company history. The historic performance was fueled by growing customer demand and increased pricing along with lower costs of raw materials and more efficient production from higher plant capacity utilization.

Revenues reached ₱4.4 billion, up 15% from the same period last year with all product categories delivering solid momentum, particularly the Foods segment.

Operating income climbed to ₱382.0 million, up by almost nine-fold from a year ago. The progress reflects the company’s multi-year plan to scale up and improve efficiency, with operating expenses now at 6% of total revenues from 10% for the same period in 2016.

VITA CEO Rocco Sarmiento commented: “I would like to thank our team for their continued commitment and resilience to meet customer needs and focus on execution. In the five years since our turnaround and corporate rehabilitation exit in 2016, VITA has consistently restored profitability, while investing in manufacturing facilities, and research and technology development. We have also positioned the business to support growth and transformation through securing internationally recognized management systems for food safety and quality, such as ISO Food Safety and Management Systems (FSMS) and recently achieved Hazard Analysis Critical Control Point (HACCP) certification. Today, our record-high performance, long-term demand expectation, and strengthened balance sheet with reduced debt give us increased confidence in our mid-term outlook of progressive margin expansion. We continue to evolve our strategy towards a fully integrated business model focusing on higher value activities. Likewise, we expect to spend ₱330 million for capital expenditures this year.”

Revenue Highlights

The Feeds segment, which accounted for 48% of total revenues, saw a 3% growth to ₱2.1 billion as a result of new commercial client wins, and stronger order intake from distributors driven by new entrants in large poultry farms and end-customers switching to VITA products. The Feeds segment manufactures and distributes animal feeds, health and nutritional products and supplements to various distributors, dealers, and end users nationwide.

The Foods segment, which accounted for 44% of total revenues, recorded a 26% increase to ₱1.9 billion due to a combination of broad-based volume growth following the easing of lockdown restrictions, and higher prices. The Food segment grows, produces, and distributes chicken broilers, which are sold to hotels, restaurants, institutional clients, supermarkets, and wet markets.

The Farms segment, which accounted for the remaining 8% of revenues, grew 43% to ₱340.6 million on better volume and prices from sale of day-old chicks.