Vitarich Delivers Record-High First Quarter Revenues

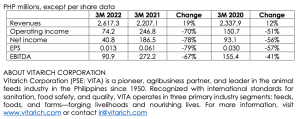

May 13, 2022– Vitarich Corporation (PSE:VITA) achieves highest ever first quarter revenues of P2.6 billion, a 19% increase from a year earlier led by the strong performance of the Foods segment.

“Two years since the pandemic began, supply chains continue to undergo significant restructuring,” said Rocco Sarmiento, President and CEO. “Businesses have increasingly diversified their supply chain risks. They are adding raw material suppliers to improve resilience. We are benefiting from that strategy. The growth in our Foods segment was driven by our hotel, restaurant, institutional (HRI) clients who have adopted enhanced risk management practices. These include finding suitable suppliers and facilitating knowledge and technology transfer to strengthen their partners and in turn, their supply chains.”

Cost of goods increased 30% to P2.4 billion mostly from higher sales volume and prices of raw materials such as wheat, soybean, and corn which rose by an average of 29% compared to the year-ago period.

Gross profit came in at P241.8 million, representing a gross margin of 9%. The rise in raw materials cost was partially offset by a favorable product mix due to higher revenue contribution from the Foods segment, which commands higher margin.

Operating expenses increased 31% resulting in operating income of P74.2 million that reflects higher freight and handling cost due to fuel prices. As a percentage of revenues, operating expenses were maintained at 7%.

Net income was P40.8 million with earnings per share of P0.013, down by 78% year-over-year but significantly higher than the previous quarter.

Chief Financial Officer Melise Arnaldo added, “In a challenging inflationary environment, we continue to monitor developments in commodity prices. Despite these headwinds, our first quarter results demonstrated our adaptability leading to market success in penetrating HRI customers. A robust foundation creates a larger potential for long-term growth, allowing us to explore investments in expansion-related projects.”

Capital expenditures in the first quarter stood at P21.3 million, including P12.0 million spent on the Feeds segment and P6.5 million on Foods. Spending on Feeds was mainly on warehouse construction in Davao and additional machinery and equipment at the feed mill plant. Foods investments were focused on improving the company’s dressing plant facilities in Bulacan.

“We expect 2022 capital expenditures to be approximately P80 million, significantly reduced from prior estimates as we optimize existing resources,” said Arnaldo.

Segment Highlights

- The Foods segment surpassed that of Feeds to become the largest source of revenues at 54%. The segment saw record first quarter results, with revenues growing 54% to reach P1.4 billion. Sales volume soared 63% while average selling prices registered a 2% increase. Segment revenues were comprised of 61% HRI customers and 39% retail. As a percentage of total revenues, HRI made up 33%.

The Foods segment sells chicken broilers, either live or dressed, to HRI customers, supermarkets, and wet markets.

- Revenues from the Feeds segment comprised 41% of revenues following an increase of 14% year-over-year. The segment posted higher volumes of 2% and selling prices of 12%. It continued to implement gradual increases in sales prices in response to raw materials and industry-wide price increases.

The Feeds segment produces and markets animal feeds, health and nutritional products, and supplements to various distributors, dealers, and end users nationwide.

- Revenues from the Farms segment accounted for the remaining 5% or P122.1 million. Fair value adjustments on biological assets amounting to P16.1 million was recognized as part of revenues and P41.9 million as part of cost of goods.

The Farms segment is involved in the production of day-old chicks and pullets.